Blogger Tax Time Tips

Need some Tax Time Tips? If you’re relatively new to the blogging world, you may be scrambling now that it’s January and tax time is right around the corner. Even if you’ve been a Blogger for several years, you might still be scrambling. Blogging is a great hobby if that’s what you set out for it to be. However, if you set out for it to be a way to earn an income, then you’re now going to have to deal with the IRS and taxes.

I, personally, dread this time of year. Not because I’m a bad United States citizen that wants to avoid paying my taxes but because I did a horrible job record keeping throughout the year. Let me just go on record by saying the best way to avoid stress at the beginning of the year is to keep great records all throughout the year.

As with most bloggers, I do most everything on PayPal. Accounts receivable and payable. This does make record keeping a bit more organized. I just spent 2 full days combing over my PayPal records this past weekend in order to attempt to get a start on my taxes. I manually entered each and every payment received and expense paid out. Yikes!!

Then I found a much more easy way to do things. Ugh, frustrating. But since I can’t get back that time for me, I thought I’d at least try to save everyone else that time. And if nothing else, have a great reminder for me next year!

If you’ve been in PayPal, you might have discovered this and are now saying out loud, “Duh, I knew that was there all along and have been using it.” Well I wish someone would have pointed it out to me before last weekend. That’s all I’m saying. 😉

Here are my tips:

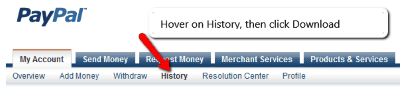

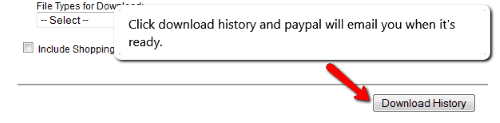

Open up your PayPal account. Hover over history, then click on Download History.

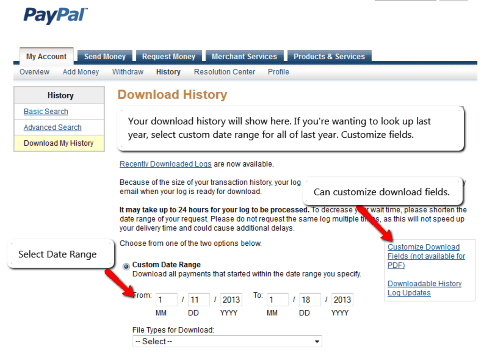

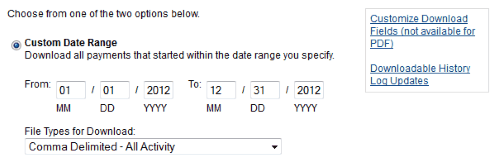

The Download History screen will come up and give you some options.

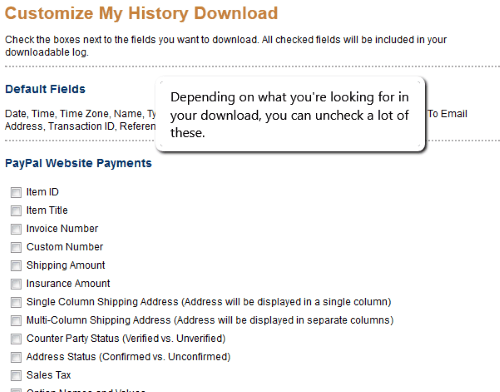

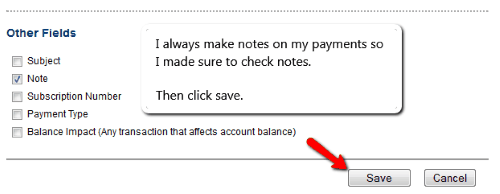

You can also customize the download fields so that you’re only getting the things you need to look at.

A good idea when sending payments is to use the “notes” in PayPal so that you have a record and can keep track of the expense.

Add in the custom date range of when you’re wanting to pull. Monthly, yearly, etc. and also the file type for download. I chose the Comma Delimited – all activity.

When you’ve selected your fields, go back and click download. If your report is large, PayPal will email you when your report is ready.

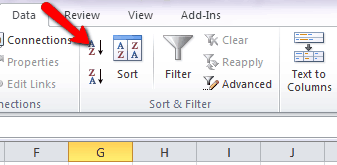

When PayPal has your download ready, you’ll be able to open this file up in Excel. Here is where the real time saver comes in. You can go through and organize this document in a few ways. Excel has this cool sort function.

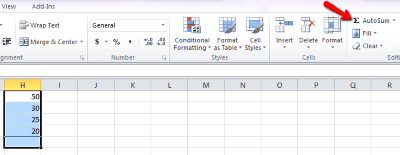

Just click on the column you want to sort, whether it be by payment type, person you paid, payment received, paid, etc. This way you can then go in and add different things and get some running totals. Adding with excel is also easy. All you need to do is find the sum function. I inserted a couple of rows in between where I wanted to add to separate the totals. Highlighted the numbers that I wanted to add and then hit sum. Done.

I could probably write another whole series on excel and not cover everything there is to know but that will hopefully give you a start if you’re a novice user.

Hope these Tax Time Tips help save you some time!

Thanks Dawn – I believe you just saved me a ton of time (and headache)!

You’re welcome! I hope it helps!

Thanks for saving me so much time trying to figure this out!

Thanks for this awesome breakdown. This is my first year and you just saved my sanity.

I’m terrible at record keeping for my blog. I’m using this to get my PayPal stuff this week. Thank you!

Oh how I wish that I had read this article this monring and not tonight. I spent the day combing through my PayPal information. I printed out all of the records and looked up each and every sent or recieved transaction as I seperated the personal from the business. What a pain! Thank-you for sharing this information. I will have a better idea of how to do it next time!

Exactly what I did, Shanna. Seems like we always go the round about way before we find an easier way to do things. 🙂 Hope it helps you for next time.